Manual vs Automated AP: The Numbers Don't Lie

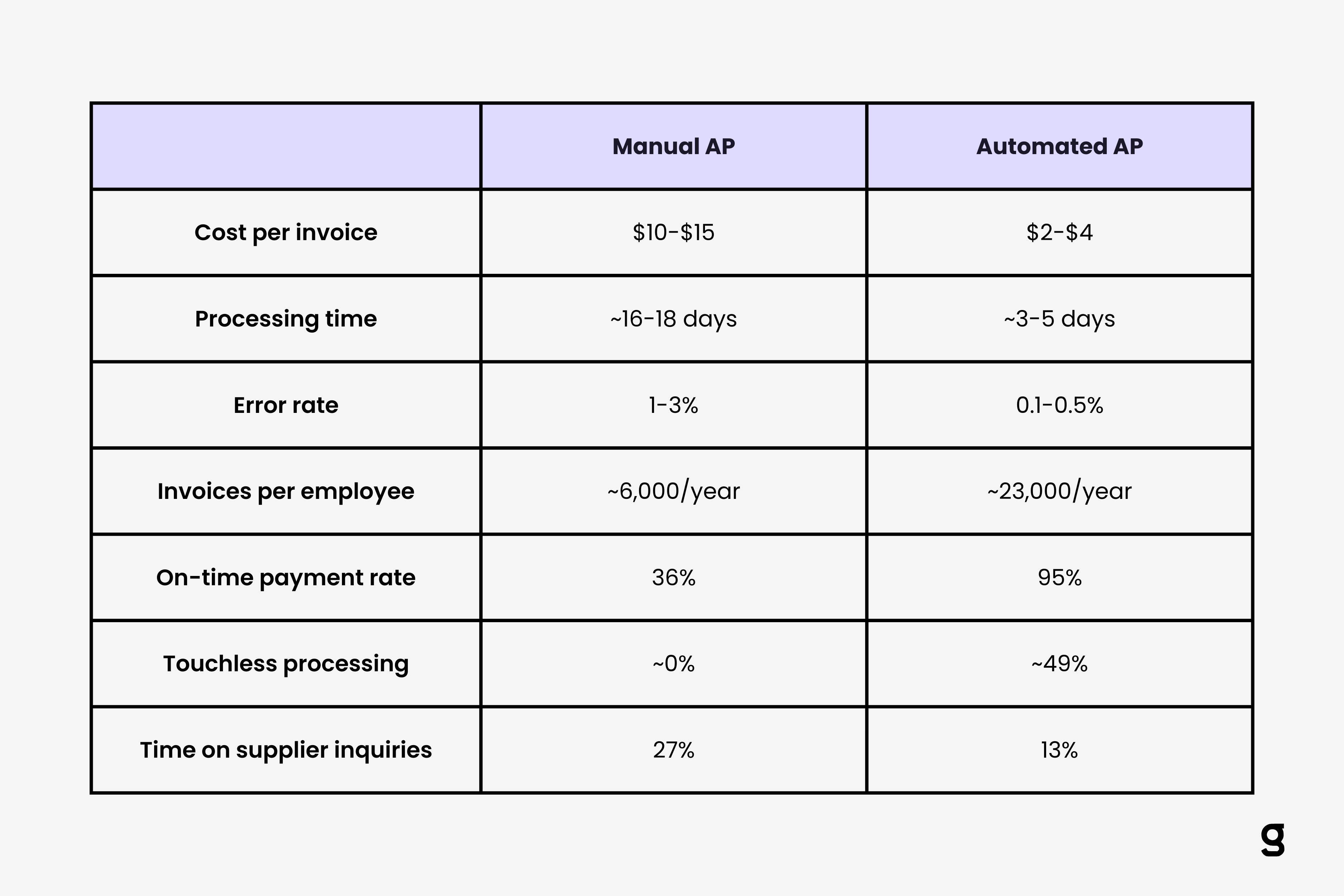

Manual vs automated AP compared across 7 key metrics: cost per invoice, processing time, error rate, and more. The data makes the case for automation.

The debate between manual and automated accounts payable isn't really a debate anymore. The data settled it years ago. But 68% of businesses still manually key invoices into their ERP or accounting software, which means most companies are paying a premium for a process that's been solved.

This isn't an opinion piece. Every number below comes from published research by organizations like the Aberdeen Group, the Institute of Financial Operations and Leadership, and major industry benchmarks. Let's put manual and automated AP side by side and see where the gaps are.

Cost Per Invoice: $12.88 vs $2.78

This is the metric that gets CFOs to pay attention.

The average organization spends $12.88 processing a single invoice through manual methods. That includes labor for data entry, time spent chasing approvals, error correction, and the overhead of managing paper or email-based workflows.

Best-in-class automated AP teams bring that down to $2.78 per invoice. That's a 78% reduction, and it comes from eliminating the manual touches that eat up time and introduce mistakes.

Let's make that concrete. A company processing 1,500 invoices per month at $12.88 each spends $231,840 annually on AP processing. Automation drops that to $50,040. The difference, $181,800 per year, is money that goes straight to the bottom line or gets reinvested in growth.

And that $2.78 figure isn't aspirational. It's what top-performing AP teams actually achieve today. The gap between average and best-in-class tells a story on its own: organizations that invested in automation aren't just saving money, they fundamentally changed how their finance teams operate. The manual teams are still doing the same work the same way, just with higher volumes and more pressure.

For a detailed breakdown of where those manual costs actually come from, including a framework to calculate your own, see our deep-dive on the real cost of manual invoice processing.

Processing Time: 17.4 Days vs 3.1 Days

Manual invoice processing averages 17.4 days from receipt to payment. Almost three weeks for a single invoice to make its way through the system. During that time, the invoice sits in email inboxes, waits on someone's desk for approval, and moves between people who each add a few days of delay.

Automated teams complete the same cycle in 3.1 days. That's an 82% reduction in cycle time.

The impact goes beyond efficiency. Faster processing means you can actually capture early payment discounts, which typically range from 1 to 3% for paying within 10 days. When you're averaging 17 days, those discounts are off the table before the invoice even reaches an approver.

Faster cycles also mean better vendor relationships. Suppliers notice when you pay consistently and quickly. That goodwill translates into better pricing, priority during supply shortages, and more flexible payment terms when you need them.

Error Rate: 1-3% vs 0.1-0.5%

About 39% of invoices processed manually contain some type of error. The error rate per data point in manual entry falls between 1 and 3%, which sounds manageable until you consider what each error actually costs.

A wrong amount means a payment dispute. A mistyped vendor code means the invoice routes to the wrong approver. A duplicate entry means paying the same invoice twice. Each of these errors triggers a resolution cycle that involves investigation, communication, correction, and re-processing.

Automated systems cut error rates to 0.1 to 0.5%. AI-powered extraction reads invoices consistently, validation rules catch duplicates and anomalies before they enter the system, and automated matching eliminates the mismatches that create most exceptions.

The math is straightforward. If 3% of 12,000 annual invoices have errors and each error costs $25 to resolve, that's $9,000 per year in correction costs. At 0.5%, that drops to $1,500. Not transformative on its own, but combined with the other savings, it adds up. And that's before counting the harder-to-measure costs: vendor frustration, delayed reconciliation, and the audit headaches that come from inconsistent records.

For a closer look at how AI-powered invoice extraction works and why it produces more consistent results than manual entry, we've covered the technology in detail.

Invoices Per Employee: 6,000 vs 23,000

A finance employee handling AP manually processes roughly 6,000 invoices per year. With automation, that same person handles 23,000, nearly four times as many.

This doesn't mean you fire three out of four AP staff. It means your existing team absorbs growth without you needing to hire. When invoice volume doubles because the business is growing, automated teams scale without adding headcount. Manual teams need to hire, train, and onboard new people, a process that takes months and costs $50,000 to $70,000 per new employee annually.

For growing companies, this is the metric that matters most. Automation doesn't just save money today. It prevents future costs you'd otherwise have no choice but to accept.

On-Time Payment Rate: 36% vs 95%

Only 36% of invoices in the United States are paid on time. More than half arrive late. That's not a process problem at this point. It's a structural one.

Manual processing is simply too slow for consistent on-time payment. The 17.4-day average cycle doesn't leave room for invoices with 15 or 30-day payment terms to clear in time, especially when approval delays add unpredictable hold-ups.

Automated AP pushes on-time payment rates to 95%. Invoices flow through capture, validation, and approval without sitting idle between steps. Payment scheduling ensures bills get paid on the optimal date, not whenever someone gets around to it.

Late payment penalties vary by vendor, but 1.5% monthly interest on overdue balances is common. For a business with $200,000 in monthly payables, even a 10% late payment rate at that penalty level costs $3,600 per year in completely avoidable fees. Factor in the early payment discounts you're missing, which typically run 1 to 3% for paying within 10 days, and the cash flow impact of manual AP becomes hard to ignore.

Touchless Processing: ~0% vs 49%

Touchless processing means an invoice goes from receipt to payment without anyone manually intervening at any point. It's the gold standard for AP efficiency.

By definition, manual AP has zero touchless processing. Every invoice requires someone to type data, someone to approve, and someone to schedule payment.

Best-in-class automated teams achieve 49.2% touchless processing. Nearly half their invoices require no human involvement at all. They arrive, get extracted, validated, matched to a PO, approved by rules, and paid on schedule, all automatically.

That 49% number is an average among top performers. Some companies achieve much higher rates for standard, recurring vendor invoices. Complex or exception-prone invoices still need human judgment, but removing the routine volume frees your team to focus exclusively on the items that genuinely need attention.

Time Spent on Supplier Inquiries: 27% vs 13%

When invoices are late or incorrect, vendors call. Best-in-class AP teams spend 13.4% of their time handling supplier inquiries. Average teams spend 26.9%, more than double.

That gap exists because manual teams generate more questions. Vendors can't get status updates, payments are unpredictable, and errors trigger back-and-forth communication. Automation solves this by processing faster, paying on time, and giving vendors visibility into payment status.

Every hour your AP team spends fielding "where's my payment?" calls is an hour they're not spending on analysis, forecasting, or process improvement.

The Verdict Is Clear

Across every meaningful metric, automated AP outperforms manual processing by a significant margin. Lower costs, faster cycles, fewer errors, higher capacity, better payment rates, and less time wasted on reactive work.

The gap isn't shrinking either. As AI-powered tools get better at extracting and validating invoice data, automated teams will continue pulling ahead while manual teams stay stuck with the same constraints they've always had. Every month you wait, the cumulative cost of staying manual grows while the cost of switching keeps dropping.

If you're ready to move from the manual column to the automated one, our complete AP automation implementation guide walks you through the process from start to finish. For a quicker start, here's how to automate invoice processing in five simple steps.

The first step is the easiest: connect your email and let AI handle the invoices. Start free with Gennai and see the numbers shift in your favor this week.

Data Sources

- Cost per invoice ($12.88 manual vs $2.78 best-in-class): Aberdeen Group / Quadient 2025 AP Statistics

- Processing time (17.4 days vs 3.1 days): Aberdeen Group / Quadient benchmarks

- 39% of invoices contain errors: IFOL / DocuClipper AP Statistics 2025

- Error rate (1-3% manual vs 0.1-0.5% automated): Artsyl / industry benchmarks

- 68% manually key invoices: IFOL AP Automation Trends Report

- Invoices per employee (6,000 vs 23,000): HighRadius AP Automation Stats

- On-time payment rate (36% US): HighRadius 2025

- Touchless processing (49.2%): Aberdeen Group / Quadient 2025

- Supplier inquiry time (13.4% vs 26.9%): Quadient 2025 AP Statistics

- Late payment penalties and early discount ranges: Industry standard terms

Ready to automate your invoices?

Start extracting invoices from your email automatically with Gennai. Free plan available, no credit card required.

Start FreeRelated Articles

How to Automate Invoice Processing in 5 Simple Steps

Learn how to automate invoice processing in 5 actionable steps: audit your workflow, connect sources, configure extraction, set approval rules, and optimize.

GuideAccounts Payable Automation: Complete Implementation Guide

Complete guide to accounts payable automation: implementation steps, ROI calculation, phased rollout, and practical advice for finance teams of any size.

GuideThe Evolution of OCR: From Rule-Based to AI-Powered

Explore OCR evolution from template matching to AI-powered deep learning. Four generations of technology transformed invoice processing accuracy from 70% to 99%.