Stop Losing Invoices in Your Inbox: The Hidden Cost Problem

Lost invoices create accounting chaos, tax problems, and waste your finance team's time. Learn the real hidden costs and how to fix invoice disorganization.

You know the scenario. Month-end is approaching. Your finance team needs to close the books. But there are expenses on the bank statement that nobody can find invoices for. The Slack messages start flying: 'Does anyone have the invoice for this $2,400 charge?' Silence.

Meanwhile, an employee finally forwards an invoice from three months ago that they 'forgot' to submit. Your accountant sighs and starts reworking the numbers.

This is not just annoying. It costs real money in ways most businesses never calculate.

The Problem Everyone Sees

The obvious costs of lost invoices are easy to spot:

Late Payment Fees

When an invoice sits buried in someone's inbox, it does not get paid on time. Most vendors charge interest on overdue amounts. A few late payments per year might seem minor, but they add up and damage your payment reputation with suppliers.

Time Wasted Searching

Every minute your team spends hunting for invoices is a minute not spent on actual work. Finance teams in disorganized companies can spend 5 to 10 hours per month just tracking down missing documentation. That is over a full work week per year, per person.

But these visible problems are just the tip of the iceberg.

The Hidden Costs Nobody Talks About

The real damage happens in places you might not immediately connect to lost invoices:

Expenses You Cannot Deduct

No invoice means no tax deduction. If your business spends $50,000 annually on deductible expenses but you are missing invoices for 10% of them, you are paying taxes on $5,000 you should not be. Depending on your tax rate, that could be $1,000 to $2,000 in unnecessary taxes every year.

Tax authorities do not accept 'I know I paid for it' as documentation. Either you have the invoice or you do not get the deduction.

Accounting That Never Balances

When expenses exist in your bank account but not in your books (because the invoice is missing), your accounting does not reconcile. This creates:

- Hours spent trying to match mystery charges

- Expenses categorized incorrectly or as 'miscellaneous'

- Financial reports that do not reflect reality

- Auditors asking uncomfortable questions

Forecasting Based on Incomplete Data

If you do not know exactly what you spent last quarter, how can you budget for next quarter? Missing invoices mean your expense tracking is always incomplete. Decisions about hiring, investments, and growth get made with flawed numbers.

CFOs and founders making strategic decisions based on incomplete financial data is more common than anyone wants to admit.

The Month-End Scramble

Every company with invoice problems knows this pain: the last week of every month becomes chaos. The finance team cannot close the books until they have all the invoices. So they chase. They send reminder emails. They escalate to managers. They delay the close.

What should take 2 days stretches to 5. Multiply that by 12 months and you have lost weeks of productivity annually.

The Organizational Drain

There is another cost that rarely shows up in spreadsheets: the human time spent chasing invoices.

Finance Teams Become Invoice Detectives

Instead of analyzing data, optimizing cash flow, or supporting strategic decisions, your finance team becomes a collection agency. They spend their days:

- Sending reminder emails to employees who have not submitted receipts

- Following up on follow-ups that got no response

- Escalating to managers when employees ignore requests

- Digging through email threads trying to find forwarded invoices

- Explaining (again) why they need the original invoice, not just the credit card statement

Employees Resent the Process

On the other side, employees hate being chased for invoices. They see it as administrative busywork. They 'forget' or 'lose' the email. The friction builds resentment between teams.

The result: a process that frustrates everyone and still does not work reliably.

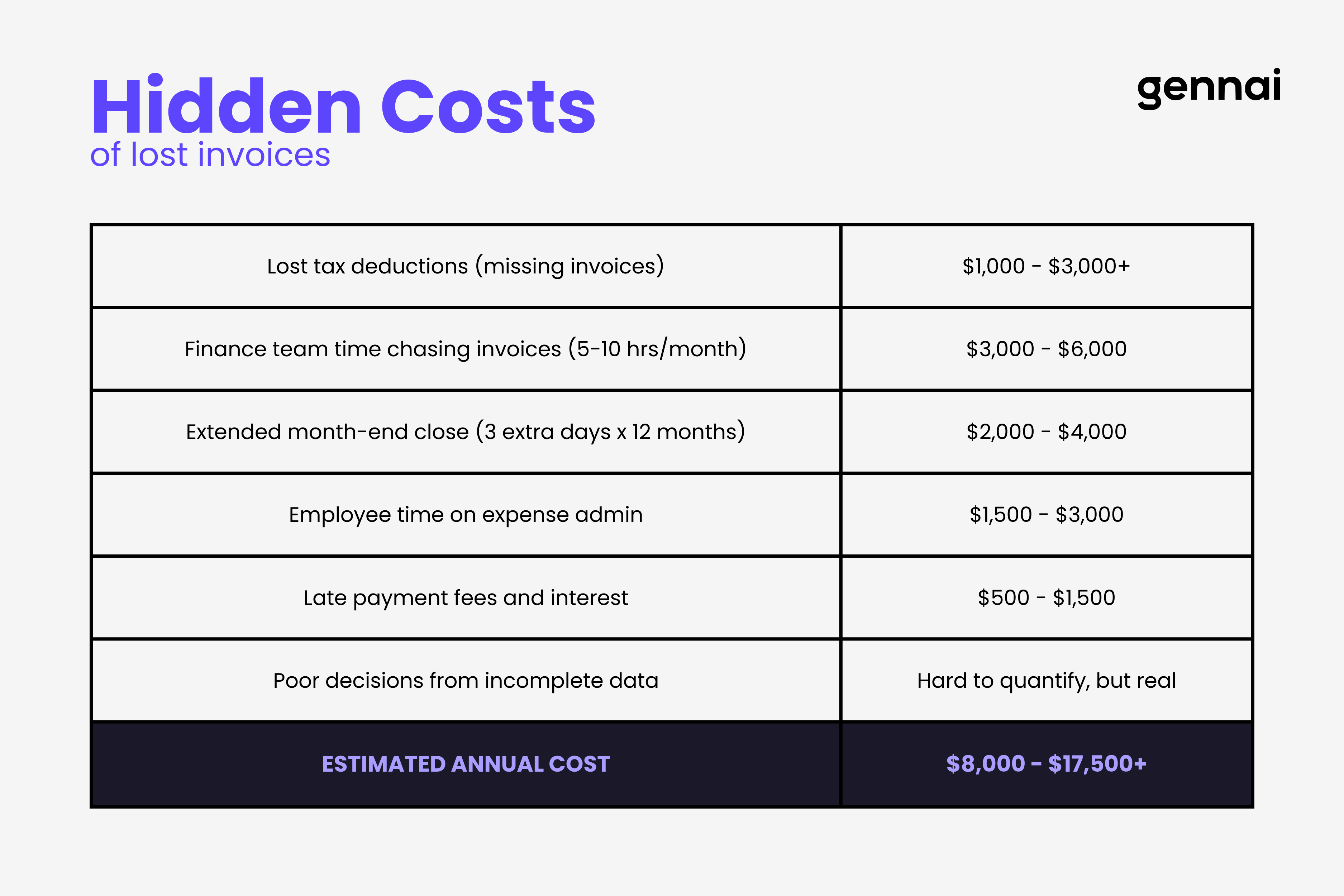

What This Actually Costs

Let us be honest about the numbers. The exact cost depends on your business size and volume, but here is a realistic breakdown for a growing company processing 100+ invoices monthly:

For larger organizations or those with poor expense processes, these numbers can easily double or triple. E-commerce businesses are particularly vulnerable due to the sheer volume and variety of invoice sources. See our guide to e-commerce invoice extraction for industry-specific solutions.

Warning Signs Your Invoice Process Is Broken

How do you know if this is costing you money? These are red flags:

- Month-end close regularly takes longer than 5 business days

- Your finance team sends weekly 'reminder' emails about missing invoices

- You have a 'miscellaneous expenses' category that keeps growing

- Bank reconciliation regularly has unmatched transactions

- Employees complain about expense reporting being 'a hassle'

- You have been surprised by expenses that 'appeared' months after they happened

- Your accountant has asked about missing documentation more than once

Fixing the Problem

The solution is not 'be more organized' or 'try harder.' The solution is removing manual work from the equation.

For a complete walkthrough on setting up automatic invoice capture, see our guide to automatically extracting invoices from email.

Automatic Invoice Capture

Modern tools can monitor email inboxes continuously and automatically detect invoices regardless of sender, subject line, or format. Every invoice gets captured the moment it arrives. No manual forwarding, no 'I forgot,' no chasing.

Centralized, Searchable Storage

Instead of invoices scattered across 15 different inboxes, everything lives in one place. Need to find that invoice from July? Search by vendor, amount, or date. Five seconds instead of twenty minutes.

Data Ready for Your Accounting System

Good invoice extraction tools pull out the key data (vendor, amount, date, invoice number) so it can flow directly into your accounting software. Less manual data entry, fewer errors, faster reconciliation.

Not sure which email platform works best for invoice management? Check out our Gmail vs Outlook comparison for invoice management. If you use Gmail, our step-by-step guide to extracting invoices from Gmail walks you through the setup. And if you want to start with free tools, see our guide on 7 email filters for invoice management.

What To Do This Week

If invoice chaos is costing you money, start here:

The companies that grow smoothly are the ones with clean financial data. The companies that struggle often have a messy invoice process at the root of it.

The good news: this is a fixable problem. And fixing it pays for itself quickly.

TL;DR

- Lost invoices cost real money in ways you might not be tracking: lost tax deductions, wasted time, poor decisions

- The hidden cost for a growing company: $8,000 - $17,500+ annually

- Warning signs: month-end close delays, weekly reminder emails, growing 'miscellaneous' category

- The fix isn't trying harder — it's removing manual work through automation

- Automatic invoice capture monitors your inbox and captures every invoice the moment it arrives

- Start this week: Ask your finance team how many hours they spend chasing invoices, then calculate what that's costing you

Ready to automate your invoices?

Start extracting invoices from your email automatically with Gennai. Free plan available, no credit card required.

Start FreeRelated Articles

Best Invoice Software for Freelancers in 2026: Issue & Receive

Complete guide to invoice software for freelancers. Compare best tools to issue invoices to clients AND organize invoices from suppliers. Free & paid options reviewed.

GuideThe Real Cost of Manual Invoice Processing (Calculator Inside)

Calculate your true invoice processing costs with our free calculator. Manual processing costs $15-40 per invoice. Discover how much your business could save with automation.

GuideDext vs Xero 2026: Honest Comparison + Better Alternative for Invoice Capture

Dext costs $24+/user. Xero doesn't extract invoices from email. Here's what actually works for automatic invoice capture in 2026 (with pricing comparison).